Learn more about Procondom

Frequently Asked Questions

Why choose Procondom?

Procondom is the result of 20 years of experience in the condom and lubricant market. Imagined by its founder Wilfried Borg , to facilitate the supply and sourcing of condoms and lubricants, for specialized resellers, associations and public establishments.

At Procondom we have been selling condoms since 2003, and we created the Condomz brand, which is now widely distributed.

With Procondom you will have the guarantee of purchasing quality products, respecting current standards and stored in appropriate conditions.

Are the products in stock?

All our products are stored in our premises in France in Montauban, Tarn et Garonne (82) with our logistics and sales teams. Procondom is a platform created by the company MB Lab.

Do the condoms offered meet current standards?

The condoms distributed by the company MB LAB, on Procondom all bear the CE marking (with an identification number) of compliance with the European Directive on medical devices.

International Certifications : Condoms are manufactured in factories certified to the highest international standards, such as ISO 4074 for latex condoms.

Rigorous Testing : Each batch of condoms undergoes rigorous testing to ensure their reliability and safety, such as puncture, elasticity and durability tests.

Regular Audits : regular audits of production facilities to ensure that quality standards are consistently met.

What is MDR (Medical Device Regulation)?

The MDR , or Regulation (EU) 2017/745 on medical devices , came into force in May 2021. It replaces the old MDD directive (93/42/EEC) and has profoundly reformed the regulation of medical devices in Europe.

Condoms are medical devices and therefore depend on the MDR.

Objectives of the MDR

Strengthening patient safety

Improve the traceability of devices

Making manufacturers more responsible

Strengthen clinical and technical requirements

What the MDR actually changes

- Reclassification of devices

Some products have changed class (e.g. lubricants moving from class I to class IIa depending on their use), which implies stricter obligations. - Enhanced clinical assessment

Strong clinical evidence is now required, even for similar products already on the market. - Post-market surveillance: Manufacturers must have robust systems in place to track the safety and performance of their products once they are sold.

- UDI and traceability

Introduction of a unique identifier ( UDI) on devices to improve transparency and tracking. - More demanding technical file: The content of the regulatory file must be more complete, particularly on composition, manufacturing, risks, biocompatibility, etc.

Impact for manufacturers

MDR involves:

- Higher regulatory costs

- Longer time to market

- Closer collaboration with notified bodies

- A significant investment in quality, documentation and clinical practice.

Example: lubricants

A lubricant can be a class I or IIa medical device depending on its purpose (simple comfort or medical use).

Under MDR, a medical lubricant: - must prove its safety and clinical efficacy.

- have CE marking based on concrete data

Why this is a good thing

Despite the complexity, MDR is beneficial for:

- user confidence (patients and professionals)

- better market transparency

-reduction of risks linked to defective or poorly evaluated devices

Traceability and compliance: Procondom supports you

As part of your activity with Procondom , we provide you with:

- MDR certificates of conformity

- product traceability information

- technical data sheets and quality documents necessary for your own regulatory compliance

Our commitment: to provide you with safe, traceable, compliant products, with full support for your B2B needs.

Are intimate lubricants medical devices?

It all depends on their stated purpose and regulation .

A lubricant can be:

- A medical device (MD) , when the lubricant is intended for medical use , such as facilitating gynecological examinations or reducing vaginal dryness in a pathological context.

cosmetic product , when the intimate lubricant is intended to improve comfort and intimate pleasure , without therapeutic claim.

DM Lubricant vs. Cosmetic Lubricant: What are the regulatory differences?

Intimate lubricant classified as a Medical Device (MD) :

- Medical use, prevention or treatment

- Marketing procedure: CE marking required (more cumbersome procedure)

- Quality control: Compliant with DM regulation (EU 2017/745)

- Clinical studies, often required.

The laboratory in charge of formulation takes care of everything.

Cosmetic Lubricant

- Use: Well-being and comfort

- Quality control: Complies with cosmetic regulations (EC 1223/2009)

- Declaration to the ANSM, a notification on the CPNP portal (Cosmetic Products Notification Portal) of the European Commission. (It is necessary to indicate the PR (Responsible Person) and establish a DIP (Product Information File) with the following information:

- Quality/quantitative formula

- Security report

- Marketing claims

- Data on adverse effects

- Compliant labeling.

The laboratory in charge of formulation takes care of everything.

Why do many brands prioritize cosmetic status?

- Simpler regulatory procedures

- Lower development costs (no imposed clinical studies), this can represent more than €60K

- Greater responsiveness on the market

This allows brands to offer safe, pleasant and high-quality lubricants, while remaining competitive.

Cosmetics ≠ discounted product

A lubricant classified as a cosmetic remains subject to a strict regulatory framework , particularly regarding safety and skin tolerance.

When to recommend a DM?

When use is linked to an identified medical need : severe dryness, clinical examinations, post-treatment.

Otherwise, for everyday uses, cosmetic lubricants are perfectly suitable and well tolerated.

What is the rule for personalized pouches containing one or more condoms?

The personalized pouches containing a condom are designed by a “packer” respecting the ISO 13485 standard, and having a contract authorizing him to work with the brand concerned, which engages his responsibility. This is the case with our partners when you ask us for these customization projects.

Can we buy condoms in bulk?

Condoms are medical devices, it is not possible to buy condoms removed from their original packaging, containing the standards and legal notices.

Modifying packaging is prohibited by distributors.

In addition, condoms cannot be sold without an information booklet and protective packaging. The only ones with an exemption are NGOs with very specific conditions.

The unit of sale is the cardboard box, not the foils inside the box.

Selling without protective packaging calls into question the protection of individual packaging (foil). A new risk analysis and a new transport study is necessary.

Under the DM regulations , a distributor who assumes the right to repackage, modify the information on the packaging, the packaging itself, must do so.

- either within the framework of a written contract with the manufacturer and each batch subject to modification must be released by the manufacturer,

- or the distributor must add his name to the packaging and take responsibility for modification, and be certified according to article 16.

Thus, a distributor who distributes condoms taken out of their original packaging is illegal.

It is however possible to buy condoms in bulk, in pouches, in boxes or bags, but in their original packaging.

Peut on vendre des préservatifs en vrac?

Les préservatifs sont des dispositifs médicaux marqués CE, mis sur le marché conformément au Règlement (UE) 2017/745 relatif aux dispositifs médicaux (MDR).

En tant que client professionnel, nous vous rappelons que ces produits ne peuvent pas être reconditionnés, ni retirés de leur emballage secondaire d’origine (boîte), en vue d’une revente ou d’une intégration dans un kit commercialisé, sans respecter les obligations réglementaires applicables.

Le retrait des préservatifs de leur emballage d’origine peut entraîner :

- la perte ou l’absence des informations obligatoires (notice, avertissements, conditions de stockage),

- un risque d’altération de la traçabilité (numéro de lot, date de péremption),

- une modification de la présentation de mise sur le marché pouvant relever des dispositions des articles 16 et 22 du MDR.

Tout reconditionnement ou mise en kit doit être encadré conformément à la réglementation européenne, et peut entraîner pour l’opérateur concerné des responsabilités assimilables à celles d’un fabricant.

Pour toute question ou besoin de solution adaptée (packaging spécifique, fourniture de supports réglementaires), notre équipe est à votre disposition.

Nous vous proposons nos pochettes personnalisées respectant toutes les contraintes légales.

Can you create your own brand of condoms?

It is possible to create your own brand of condoms, but this imposes many constraints and rules to respect, and the budget, it is in fact not possible to launch a creation project for small quantities, given the many inherent costs manufacturing, control and numerous administrative declarations to the competent authorities. However, we can support you on this project.

How much does it cost to create a condom brand in France?

Creation of a condom brand in France: regulatory, industrial and marketing framework

Creating a condom brand in France is a feasible project, provided you comply with the regulations applicable to Class IIb medical devices. Here, we present the key steps in the process, the regulatory obligations, and the associated indicative costs.

The Procondom teams can help you with your thinking, from brand creation, packaging, and e-commerce site.

1. Strategic positioning of the brand

It is essential to define from the outset:

- young adults, LGBTQ+ communities, eco-conscious consumers, etc.

- inclusion, pleasure, accessibility, sexual health, ethical commitment…

- prices, distribution channels (pharmacy, e-commerce, mass distribution, etc.)

Estimated cost : €0 to €5,000 (if carried out in-house or via an independent branding consultant)

2. Sourcing and selection of a manufacturer (OEM)

Production is usually outsourced to ISO 13485 certified manufacturers, who already have CE marked products. You have two options:

- customization of packaging only

- shape, texture, dimensions, lubricants, fragrances, etc.

Common production areas : India, Malaysia, Thailand, South Korea, China

OEM production cost : €0.04 to €0.10 / unit

Minimum quantity : often between 100,000 and 300,000 units

3. European representative (in accordance with Regulation MDR 2017/745)

If the manufacturer is located outside the European Union, it is essential to appoint a European representative responsible for:

- Legally represent the manufacturer to the authorities

- Validate technical documentation, labeling, and instructions.

- Ensure traceability , post-market vigilance and ongoing compliance

Average cost : €5,000 to €15,000/year

(Varies depending on volume, number of product references, and regulatory requirements)

4. Compliance of packaging and instructions

The packaging must include the following information:

- CE marking with the number of the notified body

- Identity and contact details of the manufacturer

- Identity and contact details of the European representative

- Instructions for use in French

- Batch number, expiry date, storage conditions

Cost of packaging development + instructions : €2,000 to €5,000

(including graphic design, printing, regulatory proofreading)

5. Declaration to the ANSM (France)

Before being placed on the market, the product must be declared to the ANSM (National Agency for the Safety of Medicines) as a class IIb medical device .

- Free process , but requires a solid and compliant technical file.

- It is recommended to rely on a regulatory expert or a specialized firm.

6. Logistics, storage and distribution

Logistics options include:

- with physical warehouse (B2B or e-commerce)

- outsourced (Amazon FBA, Cubyn, Bigblue, etc.)

- Average cost : €0.10 to €0.40 / unit accommodated

(excluding transport costs, customs, etc.)

7. Marketing & sales launch

The commercial launch must be based on:

- efficient e-commerce site (Shopify, WooCommerce, etc.)

- strong brand territory and differentiating packaging

Recommended marketing budget : €15,000 to €50,000

(depending on the channels, the duration of the campaign and the awareness ambitions)

Estimated costs (order of magnitude)

Between €35,000 and €90,000

- OEM manufacturing: €0.03 – €0.15 / unit depending on volume.

- European representative: €2,000 – €10,000/year.

- Compliance tests / labs: €10,000 – €30,000

- Technical file (if subcontracted): €10,000 – €25,000

- ANSM (National Agency for the Safety of Medicines) registration: €0

- Branding & packaging: €5,000 – €20,000

In which countries are the biggest brands of condoms made?

The largest condom brands in the world produce their products in various countries, primarily in Asia, where manufacturing facilities benefit from advanced technological expertise and economies of scale. :

1. Durex

- Production location : Durex, one of the best-known brands in the world, manufactures its condoms mainly in Thailand, China and India. Reckitt Benckiser, the parent company of Durex, has modern factories in these countries.

2. LifeStyles (formerly Ansell)

- Production location : LifeStyles (Skyn, Manix, Mates, Lifestyles brands) manufactures its condoms in Thailand, India, and Malaysia.

3. Condomz

- Location of production : Condoms from the French brand Condomz are made in India.

The place of manufacture does not affect the quality of condoms. All major brands have strict quality control procedures in place to ensure that each condom is safe and effective before being released to the market

What brands of condom are made in Europe?

1. Ritex

- Location of production :

- This brand of condom founded in 1948 is made in Germany.

2. Billy Boy

- Production location : The Billy Boy brand is another German brand founded in 1990 and manufactured by the MAPA GmbH laboratory. well known in Germany, it offers a wide variety of products that you can find here

Are there any brands of condoms made in France?

There are French brands of condoms, such as Condomz, My Lubie, Soft, Intimy, Terpan Smile... but none of these condoms come from a French factory.

Several factors may contribute to condom manufacturing in Asia:

- Labor Cost: Asian countries, especially those like China, India, and Malaysia, often have lower labor costs compared to other regions of the world. This makes manufacturing less expensive for companies.

- Industrial Infrastructure: Many Asian countries have a well-developed industrial infrastructure for manufacturing rubber products and medical products, which facilitates the production of condoms.

- Technical expertise: Some Asian countries have developed technical expertise in condom manufacturing, thanks to years of experience and investment in this sector.

- Access to raw materials: Some Asian countries have easy access to raw materials needed to make condoms, such as natural latex.

- Global Demand: Condoms made in Asia are often exported to other parts of the world due to the global demand for this product, making them a logistical and economical choice for many companies.

The largest condom manufacturer in the world is the Malaysian company Karex Industries. Karex is a leading global condom manufacturer and supplies products to many brands and distributors worldwide. such as Durex (belonging to Reckitt Benckiser), Pasante , Okamoto Industries, Thai Nippon Rubber Industry (JEX brand), notably

What are the differences between different condom brands?

We have chosen to offer you brands each offering one or more added values, so that you can offer your customers, your patients, your students or your prevention operations, an objective vision of what exists.

Condoms are distinguished by different criteria.

1 - The material (with or without latex)

- Latex

Latex is a milky, viscous liquid produced by many plants, including the rubber tree, also known as the rubber tree. It contains a complex mixture of organic compounds, including proteins, carbohydrates and lipids. When latex is harvested from rubber trees, it is transformed into natural rubber through a coagulation process.

Condomz condoms are made from natural rubber latex

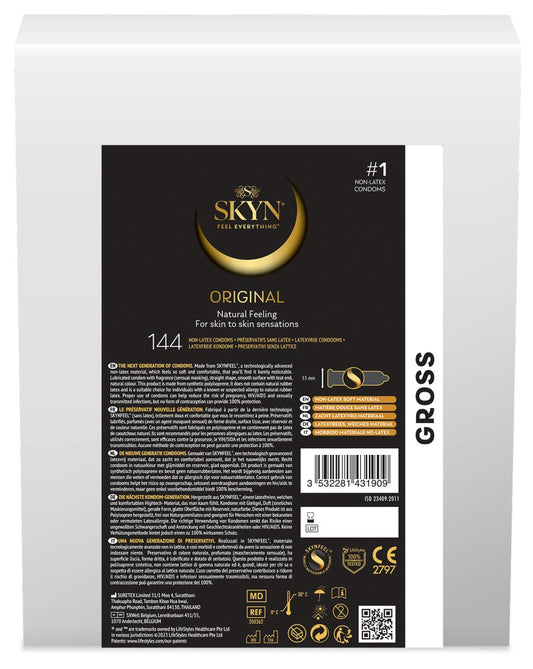

- Polyisoprene: for Skyn condoms.

Polyisoprene is a synthetic polymer that belongs to the elastomer family. It is a material similar to natural latex in flexibility and strength, but it is synthetically produced. Polyisoprene is therefore used in the manufacture of condoms as an alternative to latex, as it offers a bare skin feeling and is suitable for people with latex allergies.

- Polyurethane

It is a synthetic polymer that is widely used in various fields due to its unique physical and chemical properties. We will find Lelo Hex condoms, female condoms as well as the original Skyn condoms.

- Polyethylene: for female condoms

Polyethylene is a thermoplastic polymer widely used in various applications due to its excellent physical and chemical properties. It is one of the most commonly produced plastics in the world

- Nitrile : also for the female condom.

Nitrile is an organic chemical compound. I am found naturally in some plants, but it is usually produced synthetically on a large scale for a variety of industrial and commercial applications, including gloves.

2 - The price

Condoms have a unit price which varies between €0.15 and €2.

The cheapest condoms on the market remain condomz condoms. The founders of the brand took the challenge of offering a quality condom at a low price, so that it is accessible to as many people as possible.

A price is obviously defined by the communication effort and the investment reserved for this communication, but also the manufacturing. A non-latex condom, made of polyisoprene, is two to three times more expensive to manufacture than a latex condom.

3 - Conditioning

For economic, marketing or logistical reasons, manufacturers will make different packaging choices.

- Packages of 2, 3 or 4 for vending machines

- Packaging of 100 or 144, or 1000, in bags or boxes, in bulk or in pouches, for associations, sex workers, or to reduce production costs.

- Packaging of 10, 12, 20, 24 or 36 for traditional resellers (GMS, pharmacies, or merchant sites)

This packaging will be very refined for products intended for volume redistribution players, while it will respect marketing specifications to position a brand on its market.

4 - The offer of different sizes

Some brands offer at least two sizes, a 52mm nominal width, the so-called standard size, and a large size, around 56mm nominal width. Other brands will offer small sizes with a nominal width of 49 mm, which is the case with condomz and its “tailor-made” model. Brands like My Size pro will offer up to 8 to 10 sizes, from the smallest to the largest.

5 - The width of the range

There are single product brands (with one or two sizes) and others which offer a wide range of condoms, scented, textured, retardant, large size, ultra thin, latex free... which is the case with Lifestyles laboratories with its Manix and Skyn brands.

6 - The ethical and environmental dimension

Condoms are Vegan as long as they do not contain casein (milk protein), which is the case for Manix, Skyn and Condomz condoms. They are more respectful of the environment when the packaging contains less, little or no excess plastic, for example, the box is made from recycled cardboard. The brand will be more ethical if it uses fair trade latex, which is the case for example with the Condomz brand.

7- Its communication

The Condomz brand, for example, is a digital native vertical brand, it was born on the internet, it was first distributed to young people, and became known on social networks. It wants to be close to youth and community stakeholders. She advocates inclusion, respect for the LGBT community, consent, but her message remains the demystification of the condom, its use, and its qualities. We are not talking about sexuality, but only about condoms and prevention.

Other brands will have more medical communication oriented towards specialized distributors (pharmacy), others will take the part of speaking without taboo about sexuality, some are aimed more particularly at women.

8 - Its distribution network

Historically, in France, condoms were first sold in pharmacies, this medical device then found its place in supermarkets, or retailers, to arrive in specialized stores (Sexshops then loveshops), to finally be widely distributed on the internet. In 2012, the first online drugstores arrived, i.e. general distributors. Recently, brands are choosing to position their products on marketplaces.

Condomz.com is the first specialist site, put online in 2003. Then Manixshop.fr, and finally durexstore.fr, which became Durex.fr, then Skyn.fr.

9 - The anteriority of the brand

The iconic brand Durex was created in 1929 in London, while Manix is a brand created in 1989, Skyn arrived in 2008. The Condomz brand was born in July 2003.

Durex was bought in 2010 by the publicly listed English group Reckitt Benckizer, the group has invested enormously in communication and the development of its range. However, the Durex brand remains the most expensive brand on the market today.

The Ansell laboratory, creator of the Manix and Skyn brands, sold its brands to the Lifestyles group in 2017. This company is not listed on the stock exchange but belongs to the Ansell Limited group, listed on the Australian stock exchange.

CondomZ belongs to the French SARL MBLAB, created in 2003, whose head office is in Montauban in Tarn et Garonne, its founders remain the only shareholders of the company, and probably among the oldest active players in this market.

10 - Its ability to innovate

We will recognize the largest brands on the market, Durex, Skyn and Manix, for their ability to innovate on their product proposition. In this market, the communication of these major brands is essential with a young target to continue to accustom them to the systematic use of condoms. Without this omnipresence, the condom market would continue to decline year after year. It’s a product that requires a lot of communication.

In terms of innovation, we will cite the Lelo Hex brand and the hexagonal structure of its condom, making it more resistant and offering more sensations. The MySize brand has decided on a wide choice of sizes, from 47mm to 72mm nominal width.

We will try to enter the catalogs of other innovative brands.

To choose, what type of condoms should I offer?

It all depends on your distribution method.

For pharmacies where space is often lacking, it is advisable to offer the Skyn range, with the Elite, King Size model, and the Skyn Naurally Endless for lubricant, a water-based lubricant which gives good results. Manix lubricants remain essential, as well as Manix Endurance.

For commercial sites, it is necessary to reference the Skyn range, latex-free remains a strong demand in the market today. Condomz condoms for affordable prices and customers looking for volume.

For associations , we would strongly advise you to work on volume and personalization (duo condoms/gel for example) we have an offer adapted for this. For discovery we have a wide range of specific products (internal condoms, perfumed, etc.).

More generally, we will be able to offer you an offer or products corresponding to your needs, challenge us.

Who makes condoms in the world?

Here is a list of the world's leading condom producers , categorized by size, geographic area, and specifications . These manufacturers are responsible for the majority of brands (including private label or OEM brands).

1. Large industrial groups (multi-brand)

Karex Berhad – Malaysia

• The world's largest manufacturer

• Production: >5 billion condoms/year

• Manufactured for: Durex, ONE, distributor brands (Amazon, Carrefour, etc.)

Thai Nippon Rubber Industry (TNR) – Thailand

• Manufactures Okamoto condoms, some Skyn condoms , and other brands

• Strong export capacity

HLL Lifecare Ltd – India (Public)

• Leading condom supplier in India ( Moods brand) + UN contracts

• Major player in the humanitarian market

Ansell / Lifestyles Healthcare – Australia / Singapore

• Brand: Skyn , Lifestyles , Manix , Blowtex

• Factories in Thailand, India, Brazil (depending on the range)

Church & Dwight (Trojan) – United States

• Factory in Colonial Heights, Virginia

• Produces Trojan condoms (leader in the USA)

• Local and partially automated production

2. OEM specialist manufacturers (produce for other brands)

Unidus Corporation – South Korea

• Supplier of numerous MDDs (private labels)

• European and FDA certifications

Cupid Limited – India

• Specialized in government and NGO contracts

• Own brand and OEM

Richter Rubber Technology – Malaysia

• Humanitarian provider

• CE, ISO, FDA certified

Humanwell Healthcare / Wuhan Jissbon – China

• Big player in China

• Owner of the Jissbon brand (very popular in Asia)

3. Brands with their own industrial tools

• LELO HEX : produced in Eastern Europe (little-publicized factory)

• Glyde (Australia) : certified vegan condoms

• RFSU (Sweden) : small Scandinavian production

• Ritex (Germany) : rare independent European manufacturer

How big is the condom market in France and worldwide?

The global condom market is booming. Its value is estimated at approximately US$10.2 billion in 2024 and is expected to reach US$15.13 billion by 2029, with a compound annual growth rate (CAGR) of 8.2% over this period. Global Growth Insights+2Mordor Intelligence+2Global Market Insights Inc.+2

In France, the market is around 120 million euros with more than 108 million units consumed annually.

Durex and Skyn share 85% of the market in France.

Our condom brand Condomz

Brands

-

Mister Size

The Mister Size brand offers a range of condoms with seven different...

Product Types

-

Lubricants

Explore our collection of lubricants, specially designed to meet the high demands...

-

ATM refill

The automatic condom dispenser can accommodate refills of condom boxes corresponding to...

-

Specific products

Our generic products offer a response to your most specific needs. They...